Objectives for the Year Ending March 31, 2018

Sales (by sub-segments) and Operating Income

| Segments | Sub-Segments | March 2018 (Plan) (Billions of Yen) |

For the Next 3 Years | CAGR (%) | |

| Amount of Increase (Billions of Yen) |

Growth Rates (%) | ||||

| Equipment Business |

Imaging | 93.0 | +32.7 | 54 | 16 |

| Optical | 36.0 | +14.8 | 70 | 19 | |

| Illumination and Related Facilities |

3.0 | +0.7 | 30 | 9 | |

| Sub-total | 132.0 | +48.0 | 57 | 16 | |

| Light Sources Business |

Discharge | 70.0 | +12.4 | 22 | 7 |

| Halogen | 15.0 | +0.8 | 6 | 2 | |

| Sub-total | 85.0 | +13.1 | 18 | 6 | |

| Others | Machinery for Industrial Use and Other Business |

3.0 | -0.3 | -9 | - |

| Total | 220.0 | +60.7 | 38 | 11 | |

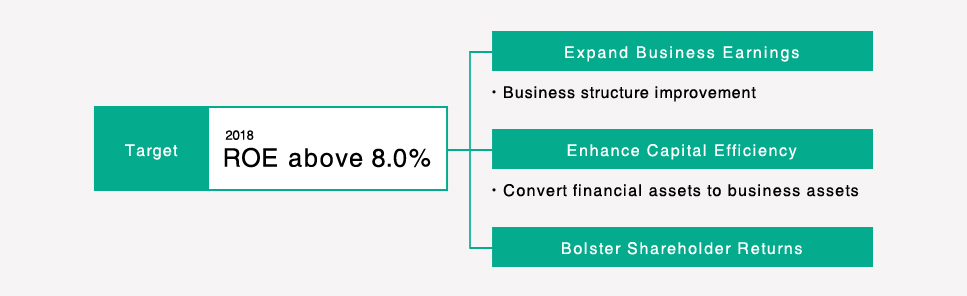

Overview of the Medium-Term Management Plan

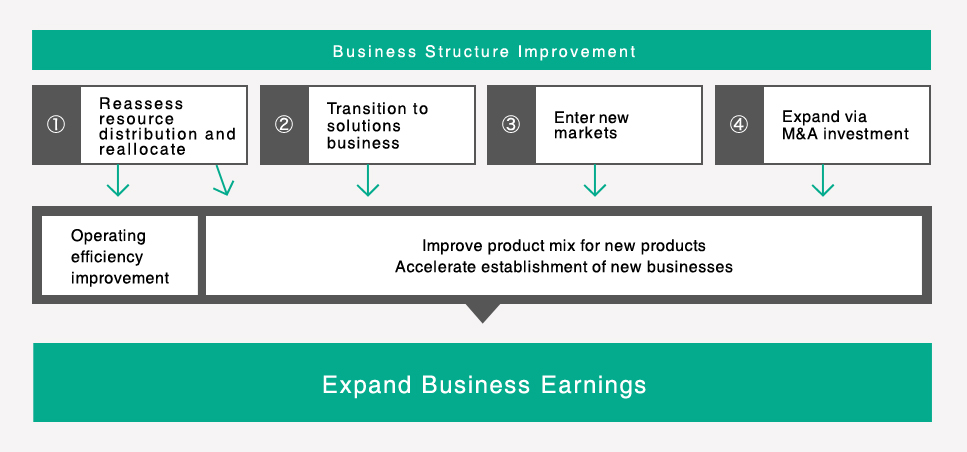

Business Structure Improvement

We will improve business structure mainly from the following four viewpoints for the expansion of business earnings. These measures will leverage existing resources to their maximum extent and control the increase of cash outflow, improving operating efficiency and speeding up the rate of new products and creation of new businesses for the future.

1) Reassess resource distribution and reallocate

On a Group-wide basis, actively allocate management resources from existing businesses to new and growth businesses.

2) Transition to solutions business

To be able to respond to increasingly diverse needs, we must develop the ability to enter new markets and domains from development through sales and move from the OEM-centered style followed until now to convert into a proposal-style solutions business.

3) Enter new markets

We will advance aggressively into new markets by creating a marketing innovations department and strengthening business strategies so that each business has a firm understanding of its roadmap.

4) Expand M&A investment

Increase the amount spent on M&A, as well as the number of M&A projects, not only to acquire technologies and sales channels, but also to aquire outstanding human resources.

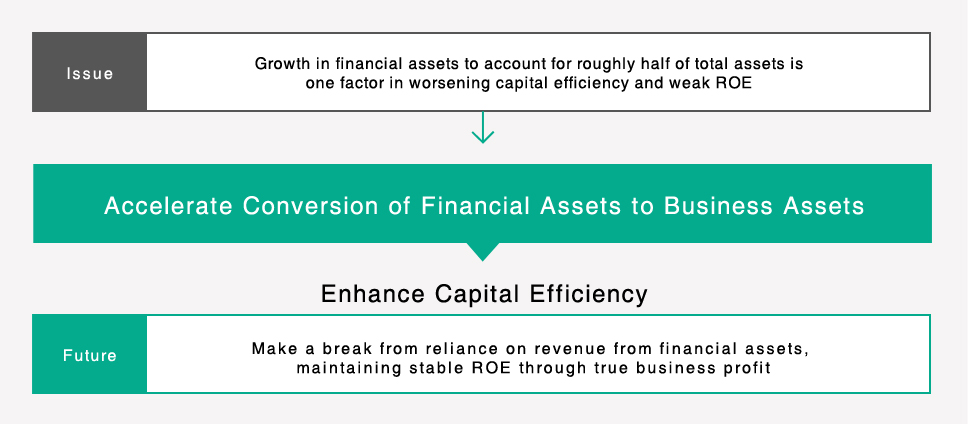

Convert Financial Assets to Business Assets

Currently, financial assets account for half of total assets. Going forward, accelerate conversion from financial assets to business assets and review policy shareholding. Cash obtained from selling policy shareholdings can be used for business investments such as M&A, moving away in the future from reliance on financial profits from financial assets to true business profits that will help maintain a stable ROE.

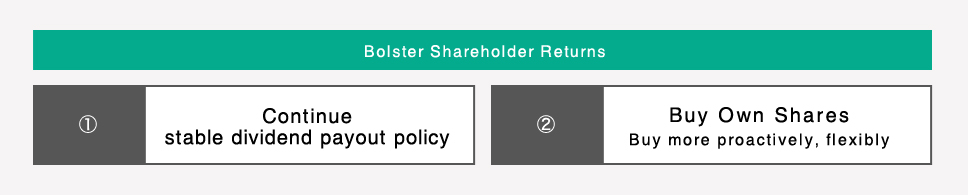

Bolster Shareholder Returns

To achieve ROE targets we must make growth investments in businesses and strengthen shareholder returns to achieve balanced capital operations. Specifically, this means a policy of greater proactivity and activity by maintaining the current policy of stable payments of dividends, and for a certain period until we have increased the certainty of achieving sustainable business growth for the future, more proactively and flexibly repurchasing shares after taking into account projected free cash flows to be gained going forward and share price trends, as well as active engagement in business growth investment.