Corporate Governance

Ushio recognizes that realizing the Vision set forth in its Management Philosophy, as well as promoting the sustainable growth of Ushio and increasing corporate value over the medium-to-long term, will bring satisfaction to all stakeholders. To achieve this goal, Ushio strives to ensure the transparency and efficiency of corporate management and to reinforce corporate governance to realize speedy and resolute decision-making.

Corporate Governance Report

Our latest Corporate Governance Report is available here.

Corporate Governance System(as of June 27, 2024)

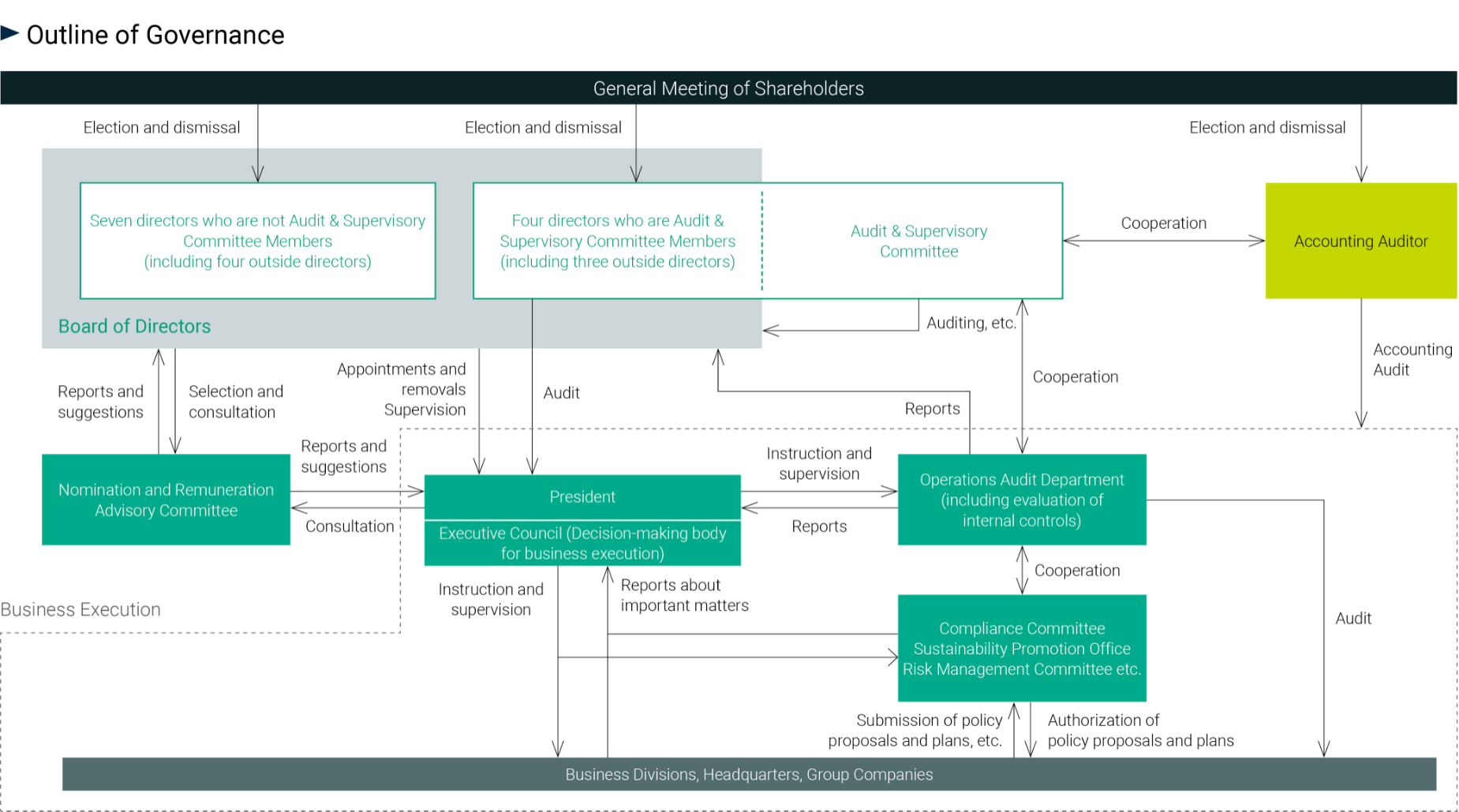

Ushio uses an Audit & Supervisory Committee system, which fosters prompt decision-making by delegating decisions for certain important business matters from the Board of Directors to the executive Directors. It has also strengthened the supervisory function of the Board of Directors by ensuring that the majority of its members are Outside Directors. The system has also been reinforcing audit and supervisory functions by having established an Audit & Supervisory Committee with the authority to assess the legality and validity of board members in performing their duties.

Furthermore, there is a Nomination and Remuneration Advisory Committee for the purpose of ensuring the fairness and appropriateness of the nominations and remuneration of Directors.

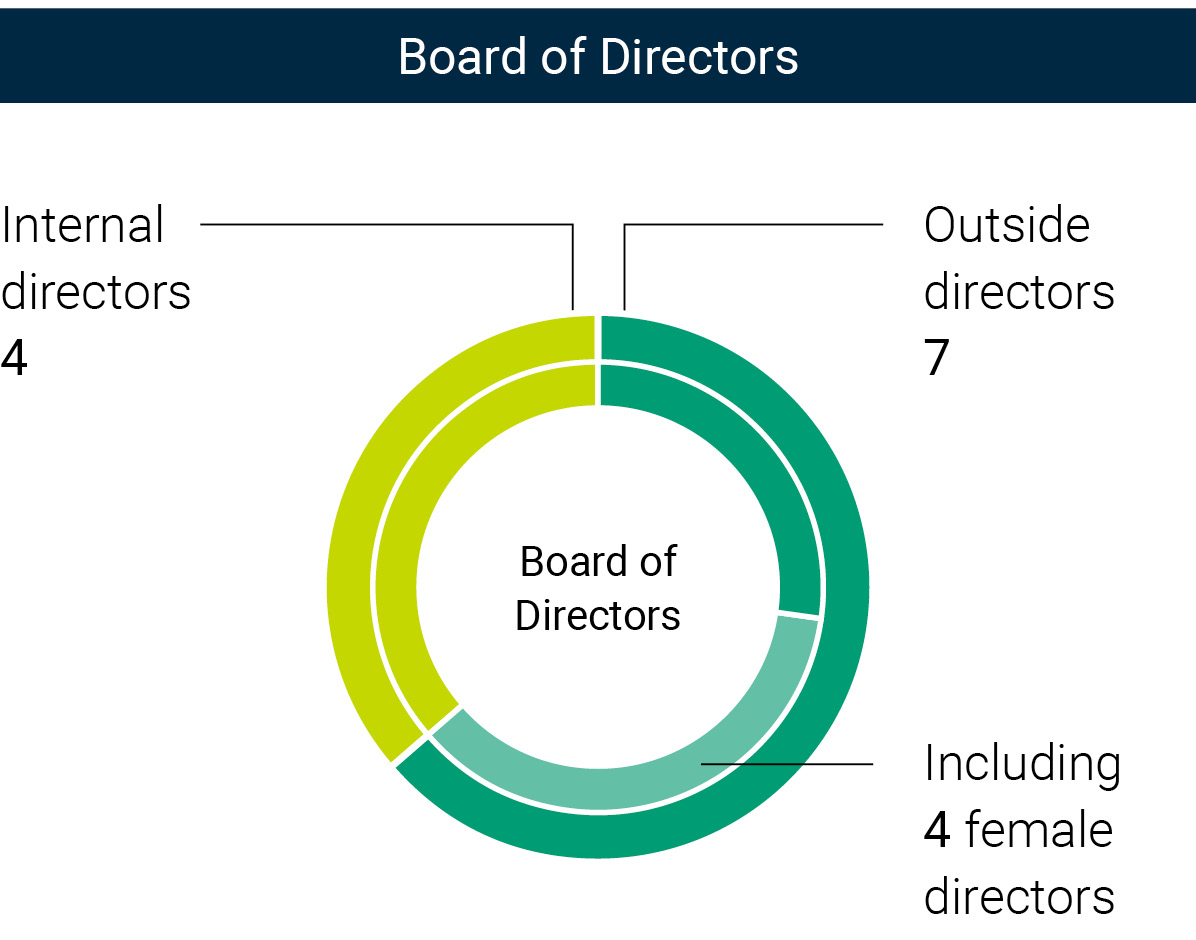

The Board of Directors comprises 11 Directors (as of June 27, 2024). Seven are not Audit & Supervisory Committee Members (including four Outside Directors), and four are Audit & Supervisory Committee Members (including three Outside Directors). The Board of Directors makes decisions on top priority issues, including basic management policies, and oversees business execution. Delegating decisions on the execution of certain important operations to Directors who manage these operations has accelerated decision-making. At the same time, the executive officer system has led to more accurate and prompt business execution. In addition, Ushio established the Executive Council to discuss and report on business execution priorities.

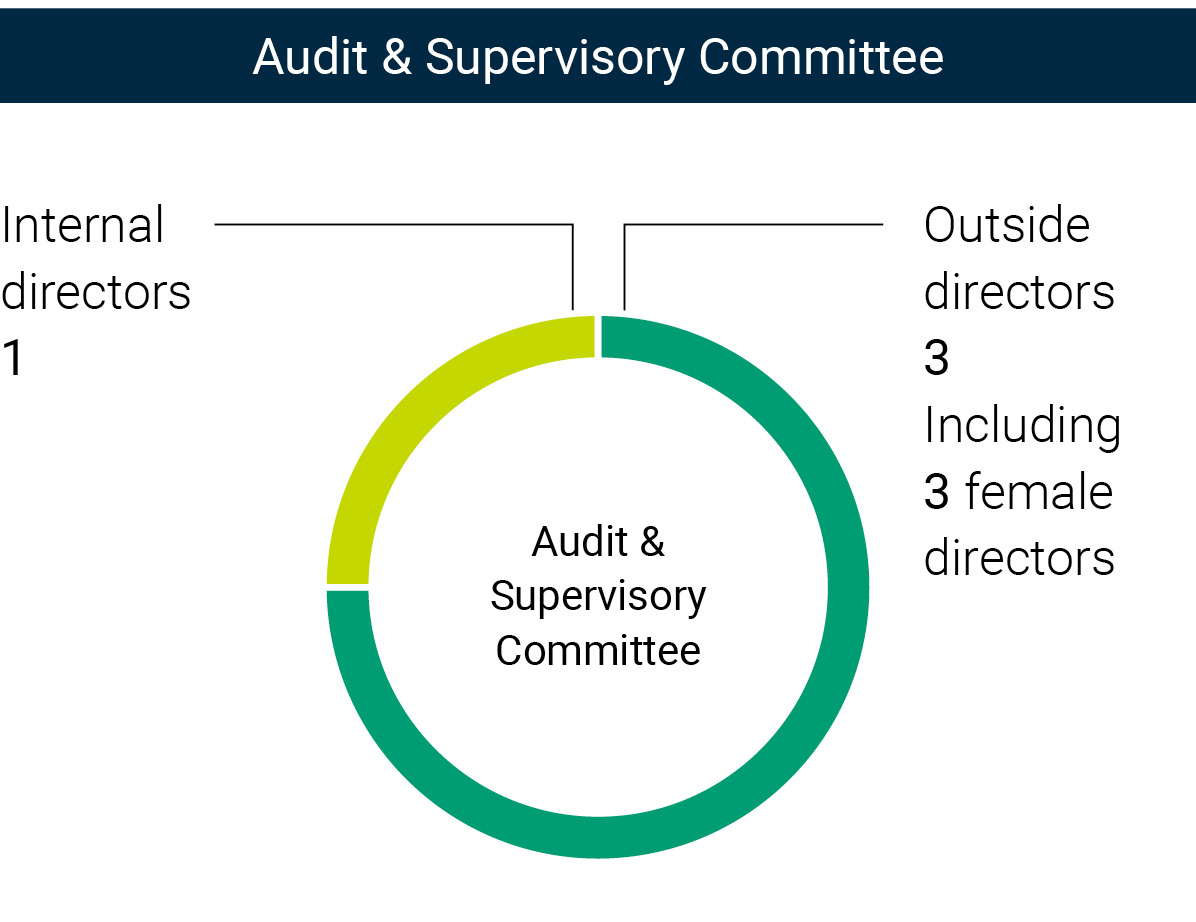

The Audit & Supervisory Committee comprises four Members (including three Outside Directors). The committee audits and oversees the Directors’ performance of duties in line with its own audit and supervising standards. Ushio appointed a full-time Audit & Supervisory Committee Member to enhance the efficacy of audits by collecting information from Directors (excluding those who are also Audit & Supervisory Committee Members) and employees and coordinating smoothly with the internal audit department and Accounting Auditor.

The Nomination and Remuneration Advisory Committee comprises five Members (including four Outside Directors). The responsibilities of the Nomination and Remuneration Advisory Committee, as advisors to the Board of Directors and the Representative Directors, consist of advice and recommendations concerning the structure and level of remuneration for Directors, evaluations of the contributions of individual Directors to business performance, and nominations of Director candidates.

Audits

Audits by the Audit & Supervisory Committee

The Audit & Supervisory Committee comprises four Members, including one full-time Audit & Supervisory Committee Member, and has been established to oversee the Directors’ performance of duties. The former full-time member Nobuyuki Kobayashi, who retired from his position at the close of the 61st Annual General Meeting of Shareholders held on June 27, 2024, has experience working in the finance departments of the Company and also possesses a high level of expertise regarding finance and accounting, and therefore he has served as the full-time Audit & Supervisory Board Member since June 2016. The current full-time member Makoto Kinoshita, who was newly elected by the resolution of the 61st Annual General Meeting of Shareholders held on June 27, 2024, has many years of domestic and international experience at financial institutions and also possesses a high level of expertise regarding finance and accounting. The member Akemi Sunaga is a certified public accountant and certified public tax accountant and also possesses a high level of expertise pertaining to finance and accounting. The member Chiaki Ariizumi has experience working in public financial institutions over many years and also possesses a high level of expertise regarding finance and accounting.

The Audit & Supervisory Committee meets once a month, in principle, to supervise the management of the Company and conduct audits on the appropriateness of business execution by the Directors. In fiscal 2023, the committee met 13 times, and the attendance rate of each individual members is as listed in the table below.

| Name | Full-time/Part-time | Inside/Outside | Number of meetings held | Number of meetings attended |

|---|---|---|---|---|

| Nobuyuki Kobayashi | Full-time | Inside | 13 | 13 (100%) |

| Rei Sugihara | Part-time | Outside | 13 | 13 (100%) |

| Akemi Sunaga | Part-time | Outside | 13 | 13 (100%) |

| Chiaki Ariizumi | Part-time | Outside | 13 | 13 (100%) |

Mr. Nobuyuki Kobayashi retired his position at the close of the 61st Annual General Meeting of Shareholders held on June 27, 2024.

As Mr. Makoto Kinoshita was newly elected as a Director who is Audit & Supervisory Board Member, attendance records for him are not described in the table above.

The main items for examination by the Audit & Supervisory Committee are formulation of annual audit plans, which include key audit matters and the division of roles between each member of the Audit & Supervisory Committee, the status of Directors’ performance of duties through regular interviews with the Representative Directors; the status and appropriateness of the implementation of the Medium-Term Management Plan and related measures; the status and appropriateness of accounting audits and internal control audits in accordance with audit plans; the establishment and operational status of Group internal control systems; the monitoring of the management status of Group companies; the status of the Company’s compliance and risk management and audit activities of full-time Audit & Supervisory Board members; in addition to other key audit matters (KAM). The audit and supervision of these various factors are carried out from the perspectives of legality and validity. In particular, audit and supervision are carried out with emphasis placed on the validity of business execution and on the status of execution of internal control audits by the Accounting Auditor and internal audit department.

In addition, with respect to sustainability issues, the Audit & Supervisory Committee conduct hearings with the department in charge of ESG regarding initiatives related to climate change, etc., and also confirm the consideration of identification, evaluation, and countermeasures for risks in the Risk Management Committee and other relevant committees.

Furthermore, to complement and strengthen the auditing of domestic and overseas group companies, the Audit & Supervisory Committee has implemented and utilized web conferencing, financial analysis systems, and management analysis systems.

The Audit & Supervisory Committee receives reports from the Accounting Auditor regarding the status and results of audit plans, accounting audits, internal control audits, audit system, and quality management system. The Audit & Supervisory Committee and the Accounting Auditor exchange opinions and information on these issues more than eight times per year through online meetings and other forms of communication. Based on the reports and other activities, the Audit & Supervisory Committee examines the assessment of the Accounting Auditor and agrees on remuneration for the Accounting Auditor. The Audit & Supervisory Committee receives regular reports from the internal audit department at least once a month at the Audit & Supervisory Committee and other channels regarding the status of business audits and the establishment and operational status of internal control systems. They actively exchange information and opinions regarding these issues.

Additionally, full-time Audit & Supervisory Board members attend vital meetings, including the Executive Council, various strategy meetings, the Compliance Committee, examine important authorized documents, and carry out on-site audits of Ushio Inc. and the Group companies in accordance with the audit assignments to enhance the audit and supervisory functions of the Audit & Supervisory Committee. They also gather information regarding the status of business execution, such as receiving reports when necessary from the departments responsible for business execution through communication with the Board of Directors and other senior management of Ushio Inc. and the Group companies. In addition, members gather information on the status of amendments to laws through outside seminars and other methods, report to the Audit & Supervisory Committee, and audit and supervise the response status of various amendments to laws in executive departments.

Part-time committee members receive reports on the status of such audits at meetings of the Audit & Supervisory Committee. Additionally, these members meet with the Company’s management and the Accounting Auditor to exchange opinions and present their valued opinions based on their expertise and from a multifaceted and objective standpoint. Furthermore, one part-time committee member is also a member of the Nomination and Remuneration Advisory Committee.

Internal Audits

The business auditing department, which is under the direct control of the president, was established as the department responsible for internal audits. The business auditing department performs on-site and written audits to check the appropriateness and effectiveness of operational controls and procedures. The department reports as necessary to the committee on the results of internal audits to the Representative Directors, the Board of Directors, and the Audit & Supervisory Committee.

The Accounting Auditor submits an annual audit plan to the Audit & Supervisory Committee and explains its specific auditing policies and methods. It also prepares summary reports for the quarterly and year-end reviews and accounting audits.

The Audit & Supervisory Committee, internal audit department, and Accounting Auditor exchange information and opinions as necessary and cooperate with each other.

Nomination and Remuneration Advisory Committee

Ushio Inc. has established a Nomination and Remuneration Advisory Committee for the purpose of ensuring the fairness and appropriateness of the nominations and remuneration of Directors. The committee gives reports in response to inquiries by the Board of Directors and the Representative Directors.

Regarding the nomination of Directors, the number of new candidates for Inside and Outside Directors is determined based on the number of Directors who resign, according to years in service and other criteria, as well as consideration for the appropriate number of people necessary to fulfill the role of the Board of Directors. This is based on Board of Directors appointment standards, independent standards, and a skills matrix. The number of candidates for Outside Directors is narrowed down from a list of candidates recommended by committee members, considering the behavioral characteristics, capabilities, and experience necessary for each candidate to effectively fulfill their professional duties (including evaluations by existing Directors regarding the degree of contribution to performance), as well as a balance of knowledge, experience, and capabilities across the entire Board of Directors. The Nomination and Remuneration Advisory Committee deliberates and makes a report to the Board of Directors to ensure a balanced Board structure, taking into account the diversity of members, including aspects of gender and nationality. The Board then makes a decision based on this report.

The Nomination and Remuneration Advisory Committee also makes recommendations regarding the business management system and the development of candidates for the next generation of management personnel.

Regarding the remuneration for Directors, the Committee provides advice and recommendations concerning the structure and level of remuneration for Directors and the Board of Directors makes appropriate decisions based on this report. Based on the authority delegated to it from the Board of Directors, the Nomination and Remuneration Advisory Committee determines the amount of fixed monetary compensation and performance-linked monetary compensation for individual directors after evaluating the performance of each Director.

The Committee is chaired by and comprises a majority of Independent Outside Directors. Members are appointed by resolution of the Board of Directors for a term of one year. In fiscal 2024, members comprise five Directors (including four Independent Outside Directors): Takabumi Asahi (Director), Toyonari Sasaki (Independent Outside Director), Masatoshi Matsuzaki (Independent Outside Director), Naoaki Mashita (Independent Outside Director) and Rei Sugihara (Independent Outside Director). The committee is chaired by Toyonari Sasaki (Independent Outside Director).

In fiscal 2023, the Nomination and Remuneration Advisory Committee met 11 times, and the attendance rate of each individual member is as listed in the table below.

| Name | Chairperson | Inside/Outside | Number of meetings held | Number of meetings attended |

|---|---|---|---|---|

| Koji Naito | - | Inside | 11 | 11 (100%) |

| Yasufumi Kanemaru | - | Outside | 11 | 10 (90.9%) |

| Sakie Tachibana Fukushima | ◯ | Outside | 11 | 11 (100%) |

| Toyonari Sasaki | - | Outside | 11 | 11 (100%) |

| Masatoshi Matsuzaki | - | Outside | 11 | 11 (100%) |

| Rei Sugihara | - | Outside | 11 | 11 (100%) |

Additionally, specific items that the Nomination and Remuneration Advisory Committee reviewed during fiscal 2023 include the succession of the Representative Director, the proposal for the governance structure (the selection of candidates for internal and outside Directors excluding Directors who are members of Audit & Supervisory Committee to be submitted at the Annual General Meeting of Shareholders in June 2024), the report on monitoring the next-generation management talent as part of the medium to long-term succession plan, the report on the revision of the executive remuneration scheme due to changes in management strategy, and the report on the execution structure for the following fiscal year.

Compliance

Ushio has established “10 Action Guidelines” to define standards for behavior that require everyone at the Group to comply with laws, regulations, the Articles of Incorporation, and Management Philosophy. The Compliance Committee is responsible for ensuring that employees observe these guidelines. The Business Auditing Department and Compliance Committee jointly perform audits to monitor the status of compliance and submit audit reports as necessary to the Board of Directors and Audit & Supervisory Committee. Furthermore, information involving the performance of Directors’ duties is recorded, stored, and managed, in documentary and electronic formats. This enables the Directors and Audit & Supervisory Committee members to view the information at any time and take timely and appropriate action as required. To reinforce awareness of the importance of compliance, all Group companies use Ushio’s standards for behavior and other guidelines and the internal audit department performs audits of the Group companies.

Risk Management

Regarding risk management in general, Ushio has implemented a risk management process under the cross-group risk management system, with the Risk Management Committee as the central axis and following the PDCA cycle. Ushio Group recognizes events that may hinder the practice of our corporate philosophy and the improvement of corporate value as "risks." Furthermore, Ushio identifies ESG risks within those risks and take appropriate measures.

In accordance with the risk management regulations, Ushio evaluates risks qualitatively and quantitatively once a year, considering specific scenarios and using two axes: impact and frequency. Assessments are conducted in each business division, headquarters, and domestic and overseas group companies. The results are collected and aggregated by secretariat the Risk Management Committee, and interviews with responsible person of responding departments are also conducted. Based on the data, information, and interview results obtained by the assessment, we select candidate significant risks, propose them to the Risk Management Committee, and report the approved significant risks to the Board of Directors.

Ushio has established a global risk management system through the Risk Management Committee, which is chaired by President and CEO and consists of members selected by the chairperson from general managers of business divisions and headquarters, and area managers of group companies.

In the event a risk materializes, and significant damages are expected to occur as a result, the responsible Director or executive officer swiftly makes a report to the Board of Directors.

Evaluation of the Effectiveness of the Board of Directors

Each year, Ushio conducts questionnaires with Directors concerning the evaluation of the effectiveness of the Board of Directors and the Nomination and Remuneration Advisory Committee, analyzes and evaluates their effectiveness, and shares the results thereof with the Board of Directors to confirm the content therein and future actions. This year's questionnaire has been conducted in the form of a self-assessment of the discussions of the Board of Directors and the Nomination and Remuneration Advisory Committee, the composition of the Board of Directors, and the effectiveness of the Board of Directors (the fulfillment of the respective roles and responsibilities of the Board of Directors, Nomination and Remuneration Advisory Committee, Internal Directors, and Outside Directors). As a result of the analysis and evaluation of such questionnaires conducted this year, it is confirmed that the effectiveness of the current status of the Board of Directors and the Nomination and Remuneration Advisory Committee has been appropriately secured in each Directors’ assessment.

At the Board of Directors held last year, the formulation of the New Growth Strategy became an important agenda item, as the Medium-Term Management Plan needed to be revised due to significant changes in the business environment surrounding Ushio. The discussion at the Board of Directors proceeded with the enhancement of the contents of the documents (the enhancement of information and data necessary to understand the background), which was raised last year as an issue to improve the quality of the discussion, and as a result, it is confirmed that the New Growth Strategy was formulated after high quality discussions on business strategy and capital policy, etc.

On the other hand, the lack of discussion on human resource strategy and R&D strategy has been identified as issues, and it has been confirmed that the Board of Directors to be held this year will enhance and deepen the discussion on these issues. It has been also confirmed that monitoring the progress of the business portfolio strategy is important to ensure the achievement of the New Growth Strategy. In addition, it has been confirmed that the appropriate composition of the Board of Directors from a medium- to long-term perspective will continue to be a matter of ongoing discussion by the Nomination and Remuneration Advisory Committee.

Ushio will continuously make ongoing improvements to further enhance the effectiveness of the Board of Directors.

Status of Outside Directors (as of June 27, 2024)

| Name | Audit & Supervisory Committee | Independent Director | Reasons for electing as a Director | Attendance of the fiscal year ended March 31, 2023 | |

|---|---|---|---|---|---|

| Board of Directors | Audit & Supervisory Committee | ||||

| Toyonari Sasaki | ◯ | Mr. Toyonari Sasaki has abundant experience and a deep knowledge of developments in global business such as the promotion of free trade. With these strengths, he provides advice and supervision for management from a fair and neutral position that is independent from the members of the Company’s management in charge of business execution. There are no special interests between Mr. Toyonari Sasaki and the Company. In addition, he satisfies the Independence Criteria for Outside Directors prescribed by the Company. Based on the above, the Company judged that Mr. Toyonari Sasaki is an Independent Outside Director who has no conflicts of interest with ordinary shareholder. | 100% (12/12) |

--- | |

| Masatoshi Matsuzaki | ◯ | Mr. Masatoshi Matsuzaki possesses a wealth of experience as a manager in a manufacturing company with global operations, and a deep knowledge of corporate governance. With these strengths, he provides advice and supervision for management from a fair and neutral position that is independent from the members of the Company’s management in charge of business execution. There are no special interests between Mr. Masatoshi Matsuzaki and the Company. In addition, he satisfies the Independence Criteria for Outside Directors prescribed by the Company. Based on the above, the Company judged that Mr. Masatoshi Matsuzaki is an Independent Outside Director who has no conflicts of interest with ordinary shareholder. Although Mr. Masatoshi Matsuzaki is the former Representative Executive Officer of Konica Minolta, Inc. with which the Company has business transactions, the percentage of such transactions against consolidated net sales of either Konica Minolta Group and Ushio Group is not more than 1% in each of the past 5 fiscal years. Further, more than 10 years have passed since Mr. Masatoshi Matsuzaki resigned the executive officer of Konica Minolta Group. Based on the aforementioned background, Mr. Masatoshi Matsuzaki satisfies the Independence Criteria for Outside Directors prescribed by the Company. |

100% (12/12) |

--- | |

| Naoaki Mashita | ◯ | As the founder and manager of an information and telecommunications and DX business company, Mr. Naoaki Mashita has been engaged in global corporate management with offices in Asia and North America, and possesses global values along with a wealth of experience and in-depth knowledge. With these strengths, he provides advice and supervision for management in general from a fair and neutral position that is independent from the members of the Company’s management in charge of business execution. There are no special interests between Mr. Naoaki Mashita and the Company. In addition, he satisfies the Independence Criteria for Outside Directors prescribed by the Company. Based on the above, we judged that Mr. Naoaki Mashita is an Independent Outside Director who has no conflicts of interest with ordinary shareholder. Although Mr. Naoaki Mashita is Representative Director, Chairman and Group CEO of V-cube, Inc. with which the Company has business transactions, the percentage of such transactions against consolidated net sales of either V-cube Group and Ushio Group is less than one percent (1%) in each of the past five (5) fiscal years. Based on the aforementioned background, Mr. Naoaki Mashita satisfies the Independence Criteria for Outside Directors prescribed by the Company. |

100% (9/9) |

--- | |

| Mika Masuyama | ◯ | Ms. Mika Masuyama has a wealth of consulting experience and knowledge in areas such as corporate governance, human capital and organizations, and M&A, and has global expertise of management and economics. With these strengths, we have judged that she can provide advice and supervision for management in general from a fair and neutral position that is independent from the members of the Company’s management in charge of business execution. There is no business relationship between the firm Ms. Mika Masuyama represents and the Company. There are also no special interests between Ms. Mika Masuyama and the Company. In addition, she satisfies the Independence Criteria for Outside Directors prescribed by the Company. Based on the above, the Company judged that Ms. Mika Masuyama is an Independent Outside Director who has no conflicts of interest with ordinary shareholders. | --- | --- | |

| Rei Sugihara | ◯ | ◯ | Ms. Rei Sugihara, as a lawyer specializing in corporate legal affairs, has in-depth specialized knowledge of laws, considerable insights into corporate management, and supervisory capabilities. With these strengths, she conducts audits and supervises management from a fair and neutral position that is independent from the members of the Company’s management in charge of business execution. There are no special interests between Ms. Rei Sugihara and the Company. In addition, she satisfies the Independence Criteria for Outside Directors prescribed by the Company. Based on the above, the Company judged that Ms. Rei Sugihara is an Independent Outside Director who has no conflicts of interest with ordinary shareholder. | 100% (12/12) |

100% (13/13) |

| Akemi Sunaga | ◯ | ◯ | Ms. Akemi Sunaga, as certified public accountant and certified public tax accountant, has in-depth specialized knowledge of financial affairs, accounting, and taxes, as well as considerable insights into corporate management and supervisory capabilities. With these strengths, she conducts audits and supervises management from a fair and neutral position that is independent from the members of the Company’s management in charge of business execution. There is no business relationship between the firm Ms. Akemi Sunaga represents and the Company. Excluding the 600 shares she owns in Ushio Inc., there are no special interests between Ms. Akemi Sunaga and the Company. In addition, she satisfies the Independence Criteria for Outside Directors prescribed by the Company. Based on the above, the Company judged that Ms. Akemi Sunaga is an Independent Outside Director who has no conflicts of interest with ordinary shareholders. | 100% (12/12) |

100% (13/13) |

| Chiaki Ariizumi | ◯ | ◯ | Ms. Chiaki Ariizumi possesses a wealth of knowledge and experience regarding analysis of the economic climate and financial markets, and a considerable degree of expertise regarding finance and accounting gained from years of experience working at a public financial institution. With these strengths, she conducts audits and supervises management from a fair and neutral position that is independent from the members of the Company’s management in charge of business execution. There are no special interests between Ms. Chiaki Ariizumi and the Company. In addition, she satisfies the Independence Criteria for Outside Directors prescribed by the Company. Based on the above, the Company judged that Ms. Chiaki Ariizumi is an Independent Outside Director who has no conflicts of interest with ordinary shareholder. | 100% (12/12) |

100% (13/13) |

Skill-Matrix

| Years of Experience | Corporate management | Global business | Finance, accounting, M&A |

Knowledge in priority businesses and related industries | IT, digital transformation | Risk management, compliance | Human capital strategy | Sustainability, ESG |

|||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Director | Inside | Takabumi Asahi | 3 | ||||||||

| Tetsuo Nakano | 1 | ||||||||||

| Kazuhisa Kamiyama | 5 | ||||||||||

| Outside | Toyonari Sasaki | 5 | |||||||||

| Masatoshi Matsuzaki | 2 | ||||||||||

| Naoaki Mashita | 1 | ||||||||||

| Mika Masuyama | --- | ||||||||||

| Director and Audit & Supervisory Committee Member | Inside | Makoto Kinoshita | --- | ||||||||

| Outside | Rei Sugihara | 4 | |||||||||

| Akemi Sunaga | 4 | ||||||||||

| Chiaki Ariizumi | 2 | ||||||||||

The skills matrix above does not represent all the experience and knowledge possessed, but rather lists what is particularly expected.

The reasons for the selection of the skill items the Company expects the Directors to possess are as follows:

| Skill items | Reason for the selection |

|---|---|

| Corporate management | The Company is listed on the Tokyo Stock Exchange Prime Market and aim to be an innovation company in the field of "light" growing together with its customers. In order to achieve sustainable growth, the Company believes that it is essential to have Directors with solid experience and knowledge in "corporate management" (equivalent to the Prime Market). |

| Global business | The Company is expanding its business in global markets, and its overseas sales have been consistently high. In order to further enhance its global business expansion, the Company believes that it is essential to have Directors with solid experience and knowledge in "global business". |

| Finance, accounting, M&A | In the Company’s new growth strategy (Revive Vision 2030), the Company has identified ROE as a KPI. In order to execute "business review" and "portfolio transformation" initiatives to improve profitability, and to successfully balance its “growth strategy” and “capital policy”, the Company believes that it is essential to have Directors with solid experience and knowledge in "finance, accounting, M&A". |

| Knowledge in priority businesses and related industries | In the Company’s new growth strategy (Revive Vision 2030), the Company has redefined its strategic areas, and stated to execute "business review" and "portfolio transformation" initiatives to achieve "steady business growth." To meet this objective, the Company believes that it is essential to have Directors with solid experience and knowledge in needs of diverse customer and stakeholders, manufacturing, technology, research and development, within the Company’s priority business as well as related industries. |

| IT, digital transformation | Amid significant changes in the business environment, the Company recognizes the increasing necessity for utilizing IT to improve management efficiency and productivity, as well as the necessity to develop from the perspective of digital transformation (DX) in order to create business ventures with significant social value. To ensure the validity of each initiative and drive the Company’s sustainable growth, the Company believes that it is essential to have Directors with solid experience and knowledge in "IT, digital transformation". |

| Risk management, compliance |

To establish structures for the Company’s sustainable growth and long-term enhancement of corporate value, the Company believes that it is essential to have Directors with solid experience and knowledge in "risk management, compliance" across all aspects of the corporate management, including the establishment and operation of internal control systems and the management of significant business risks. |

| Human capital strategy | The Company is stated “Conviction to Build Both a Prosperous Company and Prosperous Employees” in its “Management Philosophy”, aiming for simultaneous growth of the Company and its employees. To meet this objective, the Company believes that it is essential to have Directors with solid experience and knowledge in "human capital strategy," including the validation of measures to strengthen the foundation of human capital, such as the development of management talent to contribute to the sustainable growth and development of the Company, promotion of diversity and inclusion, and improvement of employee engagement. |

| Sustainability, ESG | To achieve the Company's sustainable growth and enhancement of corporate value, it is necessary to implement measures that focus on both business growth and ESG management, aiming for the enhancement of corporate value. In order to ensure the validity of these initiatives, including verifying the alignment of the direction of ESG management and various initiatives, including not only in terms of environmental issues but also in terms of external evaluations, with the trends in society and the long-term value that society demands, the Company believes that it is essential to have Directors with solid experience and knowledge in "sustainability, ESG". |

Criteria for Independence of Outside Directors

We augmented our Director selection criteria and skills matrix by establishing independence standards based on those of the Tokyo Stock Exchange. The Nomination and Remuneration Advisory Committee selects Outside Director candidates by comprehensively considering such factors as selection criteria, the skills matrix, and independence standards. The Board of Directors determines candidates based on the committee’s report. An overview of our independence criteria is in the link below for the Notice of the 60th Annual General Meeting of Shareholders: https://www.ushio.co.jp/en/ir/stocks_info/meeting.html

Directors’ Remuneration

Total Remuneration for Director Categories, Total Amount by Type of Remuneration, and Number of Eligible Directors

| Director category | Total amount of remuneration (millions of yen) |

Total amount by type of remuneration (millions of yen) | Number of eligible directors |

||

|---|---|---|---|---|---|

| Fixed compensation (monetary compensation) | Performance-linked compensation (monetary compensation) | Performance-linked compensation (stock) | |||

| Directors (excluding Directors who are Audit & Supervisory Committee Members or Outside Directors) |

330 | 146 | 105 | 78 | 5 |

| Directors who are Audit & Supervisory Committee Members (excluding outside directors) |

24 | 24 | --- | --- | 1 |

| Outside Directors | 83 | 83 | --- | --- | 8 |

- Performance-linked compensation (stock) is the amount recorded as expenses in the fiscal year ended March 2024 according to Japanese GAAP.

- The remuneration for Directors (excluding Directors who are Outside Directors or Audit & Supervisory Committee Members) comprises fixed monetary compensation, performance-linked monetary compensation, and performance-linked stock compensation. The remuneration for Outside Directors and Directors who are Audit & Supervisory Committee Members is solely fixed monetary compensation.

- At the Annual General Meeting of Shareholders held on June 29, 2016, shareholders approved a resolution to limit the remunerations for Directors (excluding Directors who are Audit & Supervisory Committee Members) to ¥540 million per year (of which the portion for Outside Directors is up to ¥84 million). In addition, the Articles of Incorporation limit the number of Directors (excluding Directors who are Audit & Supervisory Committee Members) to 12.

- At the Annual General Meeting of Shareholders held on June 29, 2016, shareholders approved a resolution to limit the remunerations for Directors who are Audit & Supervisory Committee Members to ¥84 million per year. In addition, the Articles of Incorporation limit the number of Directors who are Audit & Supervisory Committee Members to 5.

- The stock compensation system for executives was established by resolutions passed at the Annual General Meeting of Shareholders held on June 26, 2015 and the Annual General Meeting of Shareholders held on June 29, 2016, and the system was revised by the resolution passed at the Annual General Meeting of Shareholders held on June 29, 2023. Directors (excluding Directors who are Audit & Supervisory Committee Members and Outside Directors) and executive officers who have entered into an engagement agreement with the Company (excluding non-residents of Japan) are eligible to receive this compensation. During the period of the Company’s second medium-term management plan (from fiscal year ending March 31, 2024 to fiscal year ending March 31, 2026) (and thereafter the period of medium-term management plans to be formulated in the future), a maximum of ¥1,140 million is contributed to the stock compensation trust and the trust acquires up to 420,000 shares of the Company’s stock. Eligible individuals can receive up to 165,000 points per year for the final fiscal year of the period covered by this system and 127,500 points per year for the other fiscal years (one point is equivalent to one share of the Company’s shares).

- .Performance-linked monetary compensation is paid as a fixed monthly amount for the following year together with fixed monetary compensation; therefore, performance-linked monetary compensation paid in fiscal 2023 was based on the compensation system as of fiscal 2022. Performance-linked monetary compensation under the compensation system as of fiscal 2022 is, with the aim of better clarifying the connection between Director compensation and business performance and of enhancing Directors’ motivation toward improving business performance and enhancing corporate value, determined based on the Director’s position and performance evaluation (consolidated performance evaluation and performance evaluation of the division that each Director oversees) in the previous consolidated fiscal year. ROE and consolidated operating margin are used as the evaluation indicators for consolidated performance, and the ratio of achievement of business targets (operating margin of the respective division) is used as the evaluation indicator for division-specific performance. The ROE and consolidated operating margin for fiscal 2022 was used as the evaluation indicator for the performance-linked monetary compensation paid in fiscal 2023. These indicators targeted ROE of 5.0% and consolidated operating margin of 10%, and the Company’s actual results were ROE of 5.7% and consolidated operating margin of 9.1%.

In addition, with the aim of better clarifying the connection between Director compensation and business performance and of enhancing Directors’ motivation toward improving business performance and enhancing corporate value over the medium-to-long term, performance-linked stock compensation is determined based on the Director’s position and level of achievement of the performance targets and ESG target in the previous consolidated fiscal year. ROE and consolidated EBITDA are used as the evaluation indicators for the achievement of performance targets, and engagement score and ESG evaluation score are used as the evaluation indicators for the achievement of ESG targets These indicators targeted ROE of 4.3% and consolidated EBITDA of ¥21.0 billion, and the Company’s actual results were ROE of 4.5% and consolidated EBITDA of ¥21.416 billion. - The specific amount of monetary compensation paid to individual Directors (excluding Directors who are Audit & Supervisory Committee Members) in fiscal 2023 was determined by the Nomination and Remuneration Advisory Committee, which is chaired by and comprises a majority of Outside Directors, based on the authority delegated to them by the Board of Directors, with the purpose of ensuring the fairness and validity of this decision. Decisions made based on the delegated authority are made following discussions by the Nomination and Remuneration Advisory Committee regarding compensation systems, compensation levels, and the process for evaluating each Director’s level of contribution, and are deemed to be in line with the Policy on Determining Officer Remuneration Amounts and Remuneration Calculation Method. Furthermore, the Nomination and Remuneration Advisory Committee for fiscal 2023 comprises the following members.

・Chairperson: Sakie Tachibana Fukushima, Outside Director

・Vice chairperson: Toyonari Sasaki, Outside Director

・Member: Yasufumi Kanemaru, Outside Director

・Member: Masatoshi Matsuzaki, Outside Director

・Member: Rei Sugihara, Outside Director (Member of Audit & Supervisory Committee)

・Member: Koji Naito, President and CEO, Representative Director - Remuneration for directors who are Audit & Supervisory Committee members for fiscal 2023 was determined through discussions among such members.

Policy on Determining Remuneration Amounts or the Calculation Methods after fiscal period ending March 2025

In response to significant changes in the business environment surrounding the Company, the Company reviewed the Second Medium Term Management Plan, and set forth and discloses the New Growth Strategy (Revive Vision 2030) with fiscal year 2030. Accordingly, .in order to link the remuneration system to the New Growth Strategy, the Company has revised details of the policy for determining individual remuneration etc. of Directors (excluding those who are Audit & Supervisory Committee Members; the same shall apply hereinafter) and Executive Officers who have entered into a delegation agreement with the Company (the Directors and Executive Officers are collectively referred to as "Directors etc." hereinafter), of the following consolidated fiscal year onward as follows. When making this decision, the Nomination and Remuneration Advisory Committee was consulted in advance, and the Board of Directors received the report before making resolution at the meeting held on May 14, 2024.

Also, remuneration for Directors who are Audit & Supervisory Committee Members has been determined through discussions among the Directors.

1. Basic Policy on Remuneration

The basic policy on remuneration for Directors of the Company is as follows:

- Remuneration should increase motivation to achieve the Company’s management goals.

- Remuneration should lead to continuous improvement of business performance and enhancement corporate value over the medium- to long-term.

- Remuneration should be closely linked with the Company’s performance and the Company’s value, and also be highly transparent and objective.

- Remuneration should be at a level that enables recruitment and retention of diverse and talented personnel, considering the level of companies listed on the Tokyo Stock Exchange Prime Market and companies of the same size in the same industry.

- Remuneration should be determined through a transparent process to ensure the trust and support of stakeholders.

2. Policies on the Composition and Composition Ratio of Remuneration

Remuneration for Directors etc. of the Company consists of fixed monetary remuneration, short-term performance-linked monetary remuneration, and medium- to long-term performance-linked stock remuneration. Remuneration for Outside Directors of the Company only consists of fixed monetary remuneration.

Remuneration levels and remuneration ratios for Directors, etc. are determined through deliberations by the Nomination and Remuneration Advisory Committee following an objective comparative verification using executive remuneration data from an external research organization in accordance with the basic policy. The percentages of fixed monetary remuneration, short-term performance linked monetary remuneration, and medium- to long-term performance-linked stock remuneration, which are each set for Directors, etc. according to their position, are set approximately at the levels shown in the table below for when a target standard is achieved.

| Post | Fixed monetary remuneration | Short-term performance-linked monetary remuneration | Medium- to long-term performance-linked stock remuneration |

|---|---|---|---|

| Representative Director | 50% | 25% | 25% |

| Directors | 55% | 25% | 20% |

| Executive Officers | 60% | 25% | 15% |

3. Policy on Short-Term Performance-Linked Monetary Remuneration

The Company will decide on short-term performance-linked monetary remuneration in accordance with one’s position and degree of achievement of the performance targets (evaluation of consolidated performance and the performance of the unit that each Director, etc. is in charge of) for a given fiscal year in order to further increase the motivation of Directors, etc. to contribute to the enhancement of the corporate value and to encourage them to implement the New Growth Strategy (Revive Vision 2030) steadily under the basic policy. Evaluation indicators are linked to key indicators of the new growth strategy, and the relevant indicators, ratios and target values during the period covered by Phase I of the New Growth Strategy have been set as shown in the table below.

This type of remuneration is paid in a lump sum after the end of a fiscal year in an amount determined by multiplying the base amount set for each position by a factor set in accordance with the degree of achievement of each evaluation indicator. Short-term performance-linked monetary remuneration varies in value in a range between 0% and 200%

| Directors portion | Executive Officer portion | ||

|---|---|---|---|

| Indicator | ROE※ | Consolidated operating margin※ | Target achievement rate for the unit the Director is in charge of |

| Percentage | 100% | 50% | 50% |

| Target | Linked to fiscal year consolidated performance targets | Linked to fiscal year consolidated performance targets of the unit the Director is in in charge of | |

Unplanned, temporary performance impacts may occur in ROE and consolidated operating margin when making selections and concentrations (business acquisitions, divestments and exits) through portfolio transformation that will contribute to future corporate value enhancement. If this is the case, number excluding such impacts are used.

4. Policies on medium- to long-term Performance-Linked Stock Remuneration

The Company will decide on medium- to long-term performance-linked stock remuneration in accordance with one’s position and degree of achievement of the performance targets and ESG targets for a given fiscal year in order to further increase the motivation of Directors, etc. toward the Remuneration to contribute to the enhancement of the corporate value and to encourage them to implement theNew Growth Strategyy (Revive Vision 2030) steadily under the basic policy. Evaluation indicators are linked to key indicators of the New Growth Strategy, and the relevant indicators, ratios and target values have been set as shown in the table below.

The stock points for medium- to long-term performance-linked stock remuneration, which are granted to Directors, etc. at certain times each year(*1), are calculated by multiplying the base stock points set for each position(*2) by a factor set in accordance with the degree of achievement of each evaluation indicator and vary within a range between 0% and 200%. When a Director etc. resigns, the Company shares will be given to him/her in the number determined by multiplying the cumulative number of stock points granted to him/her during his/her tenure by one share per point.

| Director portion | Executive Officer portion | |||

|---|---|---|---|---|

| Indicator | ROE※3 | Consolidated operating margin※3 | Engagement Score※4 | ESG Evaluation Score※5 |

| Percentage | 100% | 70% | 18% | 12% |

| Target | Linked to fiscal year consolidated performance targets | Linked to ESG targets | ||

- In order to encourage steady execution of the New Growth Strategy, the base number of stock points set for different positions is weighted toward the final year of Phase I of the New Growth Strategy period. Accordingly, the maximum limit on the total number of stock points that can be granted to Directors, etc. per year is 165,000 points for the final fiscal year of an evaluation period and 127,500 points for the other fiscal years subject to evaluation.

- The base stock remuneration points linked to medium- to long-term performance were calculated by dividing the preset amount of medium- to long-term performance-linked stock remuneration for each position by the average closing price of the Company stock during the period from January 4, 2023 to March 31, 2023.

- Unplanned, temporary performance impacts may occur in ROE and consolidated operating margin when making selections and concentrations (business acquisitions, divestments and exits) through portfolio transformation that will contribute to future corporate value enhancement. If this is the case, number excluding such impacts are used.

- The Company defines engagement as "a state in which executives and officers find value in their relationships with their colleagues in the company and office and want to contribute actively," and uses as an engagement score the percentage of employees who have given an affirmative answer to a question indicating such state.

- FTSE Russell ESG Ratings are used as the indicator.

5. Policies on the Period and Conditions for Granting Remuneration

Fixed monetary remuneration is paid as a fixed monthly remuneration.

Short-term performance-linked monetary remuneration is paid in a lump sum after the end of each fiscal year.

As for Medium- to long-term performance-linked stock remuneration, the Company shares corresponding to the accumulated stock points granted individually are delivered, and the cash equivalent of the conversion value of the said share is paid if Directors, etc., fulfill the beneficiary requirements, in principle after retiring their positions, in accordance with the Rules on Share Delivery for Directors, etc. prescribed by resolution of the Board of Director.

In the event of a serious violation of duties by a Director, etc., the Company may forfeit the right to receive shares or demand the return of the amount equivalent to the stock remuneration already delivered.

6. Items Pertaining to Delegating Authority for Decision-Making on Remuneration

The Nomination and Remuneration Advisory Committee, whose chairperson and majority of the members are Outside Directors, deliberates and determines the system and level of remuneration for Directors, etc. and the evaluation of their contribution to the Company's performance in accordance with the delegation by the Board of Directors, in order to ensure fairness and appropriateness in determining specific remuneration amounts for individual Directors.

Cross-Shareholdings

Ushio maintains cross-shareholdings with important business partners aiming to enhance the medium- to long-term corporate value of Ushio Group through maintaining and strengthening the relationships with such business partners. The cross-shareholdings are regularly examined by the Board of Directors through comprehensively judging the medium- to long-term economic rationality of each shareholding with regard to the dividends and transaction amounts, and whether it contributes to enhancing medium- to long-term corporate value in view of business strategies etc. of Ushio Group. Any cross-shareholdings whose significance has waned will be sold after considering the status, etc. of the business partner with whom Ushio maintains cross-shareholdings. Voting rights of cross-shareholdings will be exercised after closely examining all bills from the viewpoint of enhancing the medium- to long-term corporate value of Ushio Group and the business partner with whom the Company maintains the cross-shareholding and properly judging our opinion regarding each bill. We will oppose a bill if it would significantly damage value for shareholders or if serious concerns about corporate governance such as social misconduct surface. If a shareholder of the cross-shareholdings states the intention to sell shares of Ushio, we will never attempt to impede the transaction by, for example, suggesting they reduce the transaction amount, and will properly respond to such sales.