IR Policies

This section introduces our policy for IR activities.

1. Basic Investor Relations Policy

Ushio is committed to proactively, promptly and equitably delivering accurate information to shareholders and other investors. In so doing, we comply with such relevant laws and regulations as the Companies Act and the Financial Instruments and Exchange Act, as well as stock exchange rules and regulations. We disclose timely and appropriate information about our management strategies, financial information and performances. We engage with our shareholders and other investors in constructive dialogue that helps us grow sustainably and enhance corporate value over the long term.

2. Disclosure Policy

- (1) Disclosure Standard

-

We disclose information in keeping with such laws as the Companies Act and the Financial Instruments and Exchange Act and the timely disclosure rules of the Tokyo Stock Exchange. As much as possible, we voluntarily disclose information that is material to understanding Ushio.

Statutory Disclosure

Disclosures in accordance with the

Financial Instruments and Exchange ActSecurities Reports, Semiannual Reports, Extraordinary Reports, etc. Disclosures in accordance with the

Companies ActFinancial Statements, Consolidated Financial Statements, etc. Disclosures required by the TSE

Timely disclosures Disclosures of information about corporate decisions or events for which the TSE requires timely disclosure, etc. Others Corporate Governance Reports, etc. Other disclosures

Disclosure materials related to IR activities (Financial Presentation, Medium-Term Management Plan), Integrated Reports, etc. - (2) Importance of Information

-

This policy defines material information as follows. It is information that could significantly affect share prices or which investors would want to know before making investment decisions. A specific example is information that the Tokyo Stock Exchange mandates under its timely disclosure rules. We voluntarily determine whether financial information just outside the purview of those rules is material.

- (3) Disclosure Methodology

-

Our website promptly publishes information subject to the Tokyo Stock Exchange’s timely disclosure rules after registration with the exchange’s Timely Disclosure network. We endeavor to convey other information to investors in timely and effective manners.

- (4) Forward-Looking Statements

-

Some of the information on our website may include earnings forecasts and other forward-looking statements. Management bases these statements on judgments and assumptions using information available at the time of publication. The statements include such risks and uncertainties as economic conditions, market trends, and exchange rate fluctuations. Outcomes may accordingly differ from these forecasts.

- (5) Insider Information Management

-

We manage insider information in keeping with the Regulations on Managing Inside Information and Insider Trading. We also manage insider information strictly in engaging with shareholders and other investors.

- (6) Fair Disclosure

-

We oversee significant undisclosed facts and definitive financial information about the Group that is material and could significantly affect investment decisions. We also properly disclose legally mandated material information to relevant stakeholders (including financial product traders, register financial institutions, and shareholders and other investors).

- (7) Investor Relations Quiet Periods

-

We have designated the first day of the month following the end of each quarter through the results announcement day as a quiet period. This is to ensure fair disclosure and prevent information leaks that could affect share prices. We refrain from engaging in investor relations activities or from commenting on performance forecasts or projections during such periods.

3. Policy on Constructive Dialogue with Shareholders

- (1) Basic Policy on Dialogue

-

We accommodate reasonable dialogue requests to engage constructively in dialogue with shareholders and other investors and analysts. Compliance with fair disclosure rules is a prerequisite for such dialogue.

- (2) Spokespersons

-

In principle, our president and chief executive officer, the director overseeing investor relations, and officials in that field serve as primary spokespersons for our investor relations activities to ensure accurate information and fair disclosure. We may delegate other directors or employees as necessary to speak on our behalf.

- (3) Feedback

-

The Investor Relations Department collaborates with relevant operations to gather information and enhance dialogue with shareholders. It regularly provides feedback to the president and chief executive officer and other executives about the contents of such dialogue and reports to the Board of Directors.

Reference: Number of IR meetings

FY 2022 FY 2023 FY 2024 FY 2025 Institutional investors 156 times 175 times 180 times 199 times Sell-side analysts 45 times 54 times 53 times 45 times Total 201 times 229 times 233 times 244 times

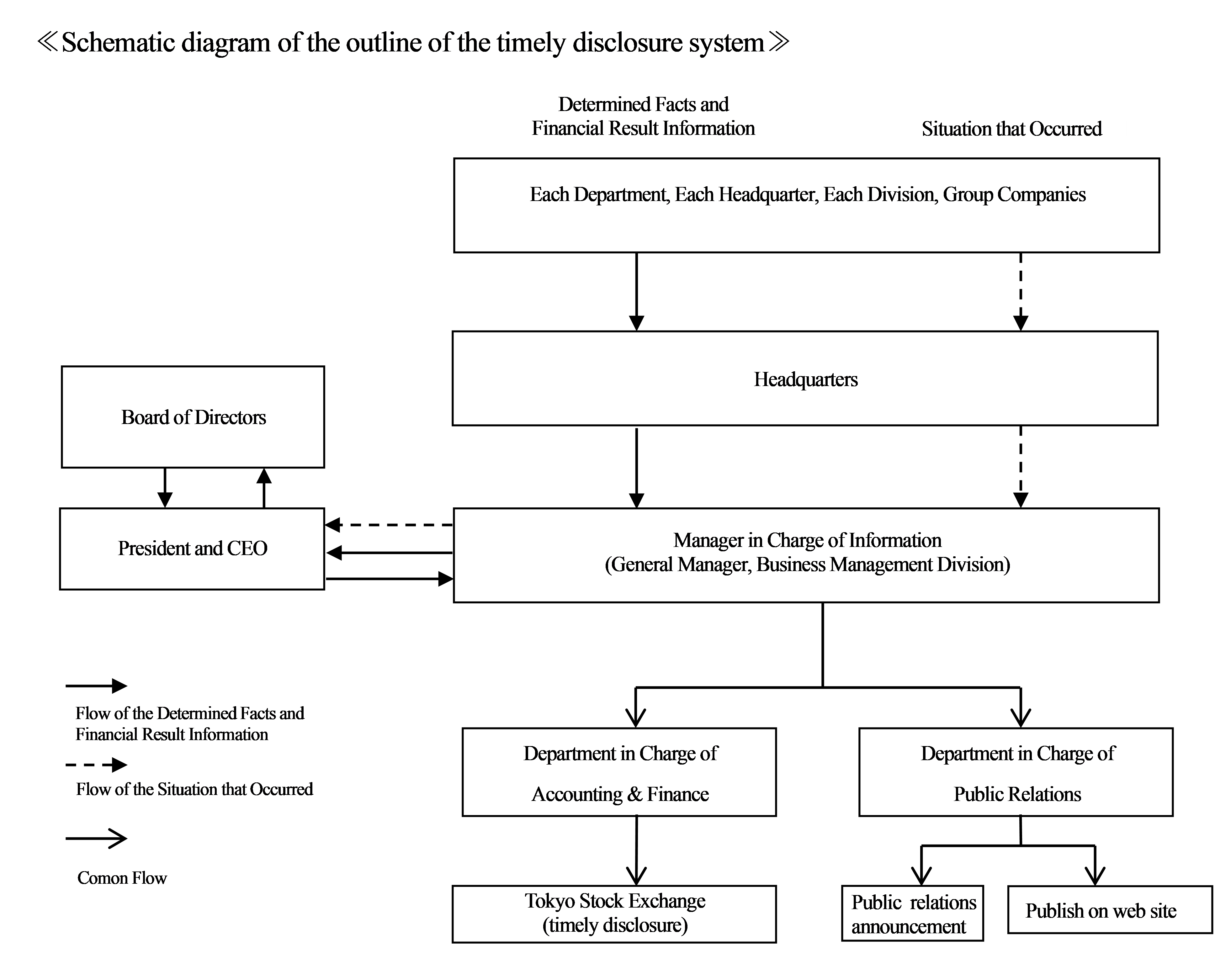

Ushio’s disclosure structure