Shareholder Returns (Dividend Policy and Buyback Policy)

Ushio’s Basic Policy on Shareholder Returns

Ushio always recognizes that returning our profits to our shareholders is the most important issue. As we strengthen our financial characteristics and management foundation, our basic policy is to generate stable and consecutive returns. With our growth investments, we will strive to strengthen shareholder returns and ensure the balanced use of our capital.

Dividend Policy

Ushio’s dividend policy is to generate stable returns. We judge it totally based on our business environment, financial result, the level of stock price and equity ratio, and we pay a year-end dividend of surplus once a year.

Buyback Policy

Ushio will flexibly repurchase shares, and limit treasury share holdings to 5% of the total number of issued and outstanding shares annually retiring portions exceeding the 5% threshold.

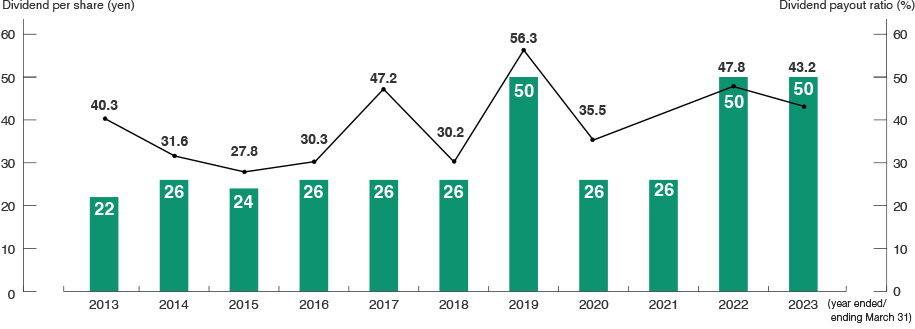

Dividend Payment

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dividend per share (yen) | 22 | 26 | 24 | 26 | 26 | 26 | 50 | 26 | 26 | 50 | 50 |

| Dividend payout ratio (%) | 40.3 | 31.6 | 27.8 | 30.3 | 47.2 | 30.2 | 56.3 | 35.5 | -- | 47.8 | 43.2 |

Details of Acquisition of Own Shares

| Purchase Period | Total Number of Shares Purchased | Total Amount of Shares Purchased | Purchasing Method |

|---|---|---|---|

| May 12, 2022 to August 31, 2022 | 2,915,400 | 4,999,993,200 | Market Purchasing on Tokyo Stock Exchange |

| April 1, 2019 to December 10, 2019 | 5,507,300 | 7,839,483,000 | Market Purchasing on Tokyo Stock Exchange |

| January 1, 2019 to March 31, 2019 | 1,712,000 | 2,160,448,400 | Market Purchasing on Tokyo Stock Exchange |

| August 1, 2016 to August 31, 2016 | 40,000 | 40,817,300 | Market Purchasing on Tokyo Stock Exchange |

| May 12, 2016 to June 13, 2016 | 670,000 | 861,584,200 | Market Purchasing on Tokyo Stock Exchange |

| February 1, 2016 to April 8, 2016 | 640,000 | 956,769,400 | Market Purchasing on Tokyo Stock Exchange |

| May 12, 2015 to June 11, 2016 | 1,138,800 | 1,999,890,100 | Market Purchasing on Tokyo Stock Exchange |

| May 20, 2014 to June 23, 2014 | 70,300 | 89,812,200 | Market Purchasing on Tokyo Stock Exchange |

| February 3, 2014 to March 20, 2014 | 801,100 | 1,006,579,100 | Market Purchasing on Tokyo Stock Exchange |

| September 6, 2011 to September 22, 2011 | 910,600 | 1,105,373,600 | Market Purchasing on Tokyo Stock Exchange |

| August 5, 2011 to September 5, 2011 | 1,500,000 | 1,905,243,000 | Market Purchasing on Tokyo Stock Exchange |

Ushio limits treasury share holdings to 5% of the total number of issued and outstanding shares annually retiring portions exceeding 5% threshold

Stock Splits

We have not operated stock splits in the past five years.

Shareholder Benefit Programs

We do not implement any shareholder benefit programs.