Environmental Management

Environmental Policy

Basic Philosophy

Ushio recognizes that coexistence with the global environment is one of the most important issues we face as a company. We will contribute to the realization of a sustainable society through environmental conservation efforts in all aspects of our business activities.

Action Plan and Activity Promotion Structure for the Environment

Environmental Action Plan

Ushio has been working to mitigate its impact on the global environment for some time. Our current environmental initiatives are important to better understand the subtleties of the environment and link them to our business in order to increase the sustainable value of the company from a long-term perspective.

Looking ahead, we will continue to identify risks, ensure that we do not miss opportunities to expand Ushio's business, and take initiatives that will lead to a reduction in environmental impact, including in the supply chain.

In addition, Ushio supports Japan's climate change policies and related laws and regulations. We contribute to efforts to realize a sustainable society by supporting and complying with relevant laws and regulations, such as Act on Promotion of Global Warming Countermeasures and Act on Rationalization of Energy Use and Shift to Non-fossil Energy.

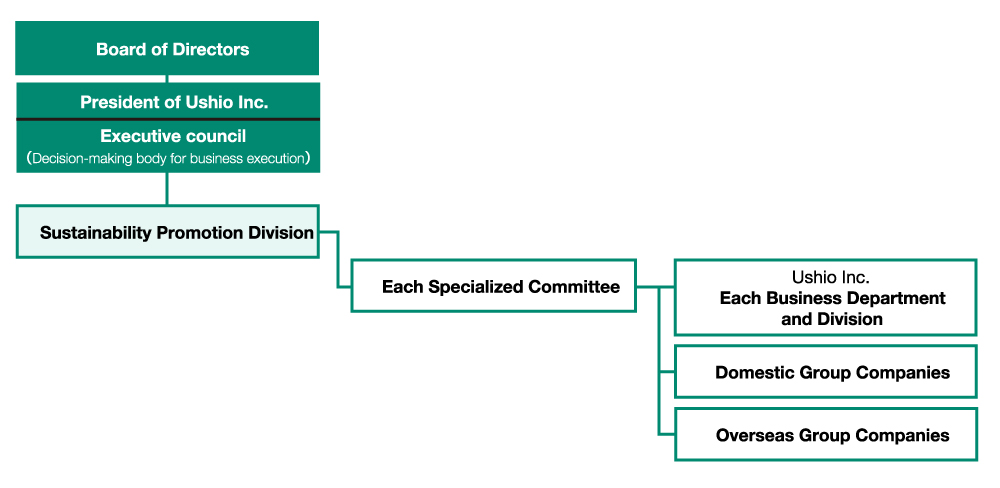

Structure for Promoting Environmental Activities

Our activities related to the environment are implemented as a theme of the Five Management Focuses. And Sustainability Promotion Department, along with other themes, coordinates and regularly reports the executive council and the board of directors for decision-making of operational matters and instructions are given as necessary. In addition, each specialized committee is working on initiatives that reflect recent trends based on previous environmental activities. In addition, reports are made to management on each individual theme as necessary and instructions are reflected in our initiatives. Furthermore, the Director, Managing Executive Officer, Vice president COO & CSuO has been appointed as the officer in charge of climate change.

Information Disclosure in Accordance with the TCFD Recommendations

Ushio declared its support for the aims of the Task Force on Climate-Related Financial Disclosure (TCFD) recommendations in 2021 and recognizes that climate change will impact the Company’s sustainable growth. Moving forward, we will continue to use the TCFD recommendations as a basis for analyzing the risks and opportunities that climate change poses to our business and reflect this in management strategies while continuing to disclose relevant financial and management information.

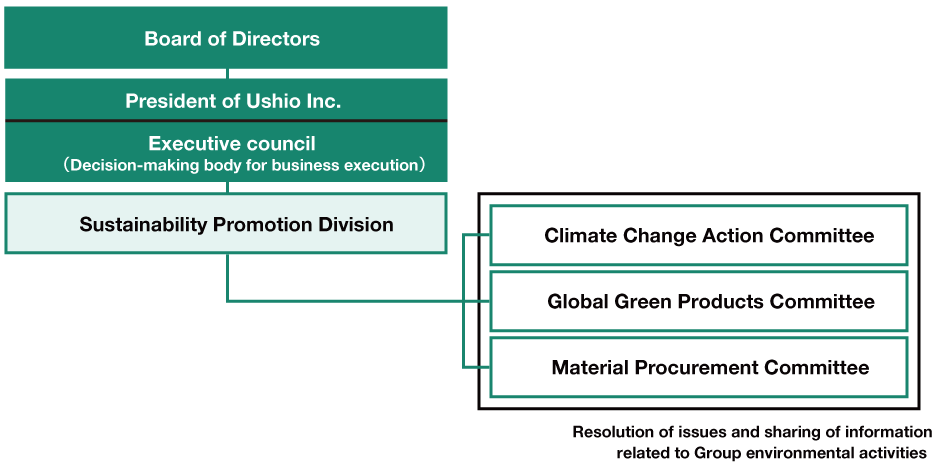

Governance

With regard to the climate-related issues examined by the Sustainability Promotion Division and relevant committees, Executive council, chaired by the President and Chief Executive Officer, meets more than four times a year to discuss such issues. It reports the results of these discussions to the Board of Directors at least once a year. In addition, the Board of Directors establishes targets for climate-related issues and monitors the progress the Company is making toward achieving those targets.

The evaluation indicators for calculating executive compensation include the achievement of ESG goals, and we have implemented a remuneration system linked to ESG evaluation scores, including environmental performance.

Structure for Promoting Environmental Activities

Strategies

Selection of Climate Change Scenarios

We have selected the 1.5°C to 2°C scenarios and the 4°C scenario from among the climate change scenarios disclosed by the International Energy Agency (IEA) and other organizations. Based on these scenarios, we analyzed the impact of climate change on our business up through 2050.

Analysis Process

We organized the major climate change-related risks and opportunities that impact our businesses based on external information, and collected data on future forecasts pertaining to each of these risks and opportunities. In accordance with this organization, we estimated the business impacts of transition risk and opportunities associated with the shift toward a carbon-free society, and physical risks stemming from climate change. We then identified important risks and opportunities that could impact our business up through 2050.

- Identification of risks and opportunities

- Collection of data on future forecasts

- Estimation of business impact

- Examination of countermeasures

Results of Scenario Analysis

As a result of analyzing the financial impacts of risks and opportunities of high importance, we identified that flooding and other natural disasters would have a significant impact on our production bases, especially under the 4°C scenario. Meanwhile, we confirmed that we could mitigate the impact of climate change-related risks by making appropriate insurance arrangements at the applicable production bases.

Main Risks in the Area of Climate Change

| Type | Time Frame*2 | Overview and Financial Impact Measures |

||

|---|---|---|---|---|

| Transition risks | Carbon pricing, carbon emission targets and policies in each country | Carbon tax | Medium-term | <Overview and Financial Impact> Enactment of a carbon tax on GHG emissions would increase operating costs by ¥200 million under the 1.5°C scenario and by ¥160 million under the 2°C scenario.*1 <Measures> Reduction of GHG emissions by adopting renewable energy, etc. |

| Rise in cost of raw materials | Copper price | Long-term | <Overview and Financial Impact> Supply and demand for minerals could become more pressing following the increased demand for low-carbon technologies (solar power, EV batteries, etc.). As a result, mineral prices and raw materials prices could rise. <Measures> Enhancement of supply chain management |

|

| Zinc price | ||||

| Molybdenum price | ||||

| Physical risks | Water shortages | Profit losses due to drought | Medium-term | <Overview and Financial Impact> Product production could be delayed or suspended due to restrictions on water intake in the wake of water shortages, and profit losses could occur as a result. <Measures> Adoption of recycled water at some bases where there is risk of water shortage |

| Intensification of abnormal weather | Property damage and profit losses caused by floods | Short- to medium-term | <Overview and Financial Impact> Product production could be delayed or suspended due to damage to our production bases caused by floods. The related property damage costs and profit losses would total ¥6.68 billion under the 4°C scenario. However, ¥6.67 billion of this amount could be covered by insurance. <Measures> Strengthening resilience through the establishment of a business continuity plan (BCP) |

|

| Increased insurance rates | Short- to medium-term | <Overview and Financial Impact> Insurance rates and costs could increase due to greater risk of damages at production bases resulting from the intensification of floods and typhoons. <Measures> Review of insurance content according to status |

||

Main Opportunities in the Area of Climate Change

| Type | Time Frame*2 | Overview and Financial Impact*3 | Measures | ||

|---|---|---|---|---|---|

| Products and services | Business Creation Division | Short- to medium-term | Growing interest and demand for improving the environmental performance of products and reducing their carbon footprint will lead to increased development of Green Products. | Development of a system for decomposing N₂O gas with high global warming potential | |

| Industrial Processes | Short- to medium-term | Financial impact: High | Sales of related products will expand in line with growing demand for semiconductors used in environmentally friendly vehicles (EVs, etc.), home appliances, and electronic devices, each of which helps reduce GHG emissions. | Development and supply of semiconductor-related products (lithography equipment for packaging, super high-pressure UV lamps, etc.) | |

| Visual Imaging | Short- to medium-term | Financial impact: Medium | Rising demand for energy conservation will lead to an expansion in the transition to and new installation of more energy-efficient light sources. | Initiatives and development to improve energy-efficient products | |

| Increase in resource efficiency | Short- to medium-term | Reduction of energy costs through streamlining of manufacturing and distribution processes | • Achieving energy targets • Transition to and new introduction of high-efficiency facilities and delivery methods |

||

| Energy sources | Short- to medium-term | Decrease in costs of renewable energy and increase in opportunities for usage due to promotion of energy saving | • Transition to renewable energy • Installation of solar power equipment at Company factories |

||

| Other | Short- to medium-term | Increase in investment opportunities due to growing approval from society as a company working on decarbonization | • Disclosure of GHG emission reductions • Response to trends in regulations and related bodies |

||

Risk Management

For risk management, we appoint responsible departments and directors or executive officers in charge of response for each type of risk. Climate change risks are regularly identified under the company-wide Risk Management Process, evaluated and monitored by the Risk Management Committee (Chair: President and CEO), and risks assessed as significant are reported to the Board of Directors. In addition, opportunities related to climate change are comprehensively identified by the Sustainability Promotion Department, leading related departments and group companies. These opportunities are identified and evaluated based on importance and validity. For monitoring purposes, those opportunities are reported regularly to the Management Meeting, and opportunities assessed as significant are reported to the Board of Directors.

Indicators and Targets

-

Indicators

We have established the following two indicators and are monitoring our progress on climate change-related initiatives accordingly.

- GHG emissions (Scope 1, 2, and 3)*1

- Net sales of green products and super green products*2

*1:

The Company’s GHG emissions are displayed on its corporate website on a consolidated basis and by region and scope. Amounts have been calculated based on the GHG Protocol.

*2:

When the environmental performance of a product has been improved based on this evaluation, it is certified as "Green Product." If a product is outstanding even among green products, and uses innovative environ mental technology on a completely different level from existing products, it is certified as Super Green Product.

-

Targets

Based on the global stance on climate change, we set SBT (science-based targets) in 2018 and received certification. These targets are revised regularly, and we currently aim to achieve a 55% reduction in Scope 1 + Scope 2 GHG emissions by fiscal 2030, compared with fiscal 2017, and a 48.3% reduction in Scope 3 emissions. We will not only reduce CO₂ emissions from the activities at our business sites but also pursue the development of green products to reduce Scope 3 emissions during the product use stage. We are also considering setting targets to make the Group carbon neutral in Scope 1 + Scope 2 by 2050.