Corporate Governance

Ushio recognizes that realizing the vision set forth in its Management Philosophy and promoting sustainable growth of Ushio and increasing corporate value over the medium to long term will bring satisfaction to all stakeholders. In order to achieve this goal, Ushio strives to ensure the transparency and efficiency of corporate management and to reinforce corporate governance for realizing speedy and resolute decision making.Specifically, please see Corporate Governance Initiatives.

Tax Policy

Ushio Group Tax Policy

Ushio Group recognizes that one of the important social responsibilities of a company is to pay appropriate amounts of tax by complying with the relevant tax regulations in each operating jurisdiction and to ensure tax transparency.

1. Tax Compliance

- Ushio Group fulfills tax payment obligations in an appropriate manner by complying with the relevant tax regulations in each operating jurisdiction.

2. Tax Governance

- Under the supervision of the Senior Executive Officer, the Accounting & Finance Department oversees, reports and manages tax affairs of the Group Companies, and reports material tax issues to Board of Directors.

3. Tax Risk Management

- Ushio Group strives to reduce tax risks by consulting with external advisors appropriately in the event of uncertain tax interpretation being occurred.

4. Tax Planning and Transfer Pricing

-

Ushio Group utilizes applicable tax incentives appropriately in the normal course of business activities by understanding the relevant tax regulations in each jurisdiction.

Ushio Group strives to pay appropriate amount of tax and never use artificial structures for tax planning which lack commercial substance.

Regarding to the intercompany transactions, Ushio Group sets arm’s length price based on analysis of functions and risks, and conduct appropriate income allocation in line with the contribution.

5. Relationship with Tax Authorities

- Ushio Group strives to maintain cooperative relationships with tax authorities by responding to inquiries from tax authorities in a prompt and courteous manner.

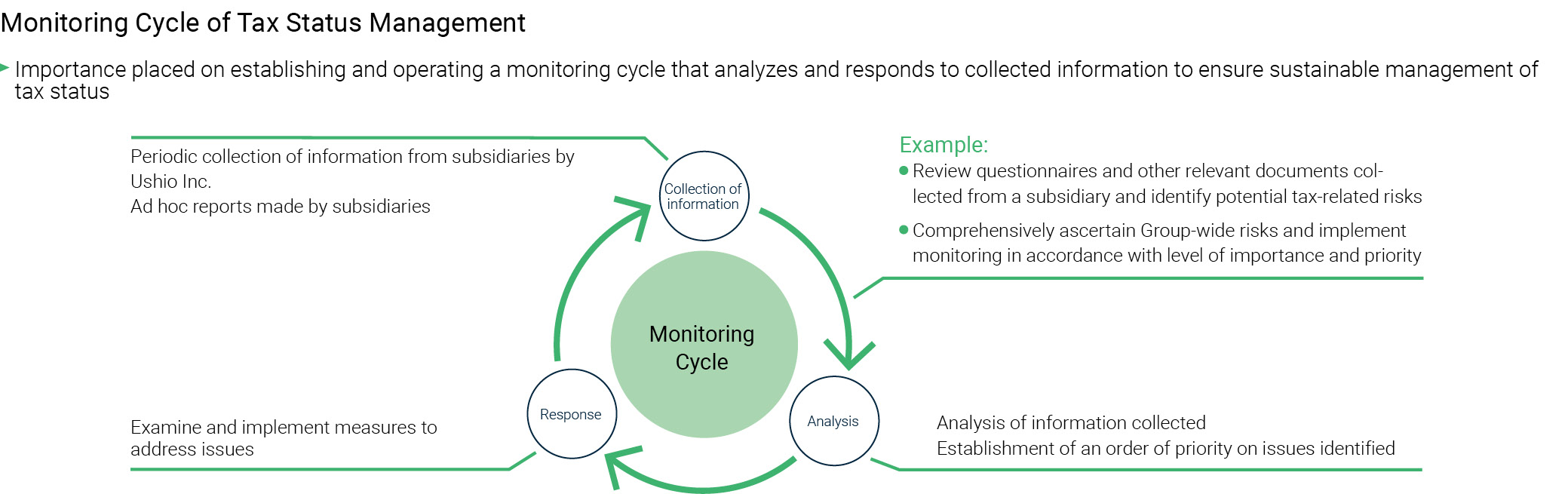

Tax Governance

As tax-related duties are significantly impacted by the tax regulations of each country, individual Group companies perform operations such as gathering information on amendments to their countries’ respective tax systems and identifying tax risks, with Ushio Inc. working to ascertain Group-wide tax costs and establish tax management systems. We position global tax governance as a key issue for enhancing our corporate governance and are working to enhance Group-wide tax transparency.

Group-wide tax management regulations are enforced to confirm the tax declaration status of each Group company, trends in tax investigations, and responses to amendments in tax systems. Additionally, transfer pricing documents for each country are managed by Ushio Inc. to reduce tax risks.

Going forward, we will strengthen cooperation with Group companies, appropriately manage tax risks through the execution of management cycles, and take measures to optimize tax costs by reducing tax risks associated with the transfer pricing systems of each country and making effective use of preferential taxation systems and other systems in each country. We will also ensure that we respond in a timely and appropriate manner to changes in international tax rules.