Risk Management

Ushio Group has carried out our risk management in an integrated manner by assigning responsible departments and person in charge of responding to each type of risk, then implementing cooperation between the relevant departments at each Group company. While the business environment becoming more uncertain every year, we have been reviewing our system since FY2022 and have established our risk management policy and the Risk Management Committee with the aim of rebuilding and stregthening our group-wide risk management system. Since FY2023, we have been conducting our own risk assessments, and the Risk Management Committee has been identifying critical risks and promoting countermeasures.

Going forward, through PDCA cycle of risk management, we strive to enhance trust among all stake holders, achieve the Ushio Group's management targets, and realize sustainable growth.

Risk Management Policy

Basic Approach

Ushio Group aims to achieve its management goals and realize sustainable growth by accurately identifying, evaluating and responding to risks that may impede the implementation of its Management Philosophy and the enhancement of its corporate value. We also strive to fulfill our social responsibilities as a company, ensure that we continue to earn the trust of our stakeholders, and reinforce and enhance our governance systems.

Basic Principles

- 1.

- We will establish and implement a comprehensive, all-encompassing risk management system in order to manage risks related to the business activities of the entire Ushio Group.

- 2.

- We will identify, analyze, evaluate and review risks, and shall engage in information sharing and appropriate risk management activities in order to reduce risks and prevent the materialization of risks.

- 3.

- We will respond with promptness and precision in the event that an incident does occur, and shall implement recovery measures to minimize losses, then make improvements to prevent recurrences.

- 4.

- We will strive to build both a prosperous Company and prosperous employees and work to protect our assets.

- 5.

- We will strive to achieve sound and stable management while supporting happiness for people and the development of society.

Risk Management

Risk Management Process

We have introduced a risk management process where the Risk Management Committee spearheads the management and oversight of the PDCA cycle for enterprise risk management. Specifically, we implement risk management company-wide using a cycle of policy formulation, plan formulation, education and training, risk response, assessment and monitoring, and review.

Risk Management System

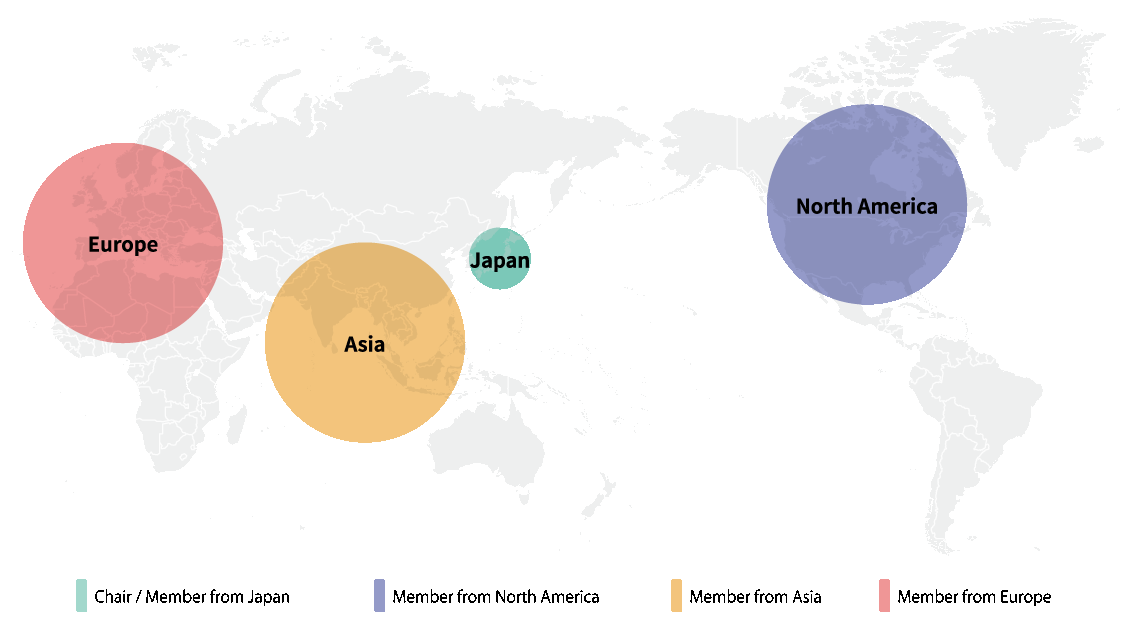

We have established the Risk Management Committee, chaired by the President and Chief Executive Officer who selects committee members from among the heads of business divisions, headquarters, departments and Group companies, and put into place a system for global risk management. When risk materializes and serious damages are expected to be incurred, the director or executive officer responsible reports promptly to the Board of Directors.

*The Risk Management Committee consists of Operations Audit Department and Audit & Supervisory Committee.

Supervision of Risk Management

Supervision of Risk Management by Directors

Ushio has established a Risk Management Committee chaired by the President and Chief Executive Officer and comprising members nominated by executive directors and the President and Chief Executive Officer. Risk management pertains to the entirety of Ushio Group and is the responsibility of the President and Chief Executive Officer, who is the Chair of the Risk Management Committee. Risk assessments are carried out throughout the Group, and reports are submitted to the Risk Management Committee. In addition to monitoring these activities, the committee conducts identification, evaluation, formulation of response plans, and monitoring with regards to significant risks across the entire Group. These measures are reported to the Board of Directors, which evaluates the effectiveness of risk management based on the content of these reports. In principle, the Risk Management Committee meets at least three times each year and holds emergency meetings as necessary. This series of processes carried out by the Risk Management Committee takes place independently from the Audit & Supervisory Committee.

Composition and Role of the Risk Management Committee

| Committee Chairperson | President and Chief Executive Officer |

|---|---|

| Director of Risk Management Control | Appointed by CEO: serving as deputy-chair of committee |

| Member | Persons in charge of risk management (heads of divisions, headquarters, and departments, as well as area manager of Group companies) |

| Goal | All risk assessments involving the company Deliberation on and management of material risks |

| Role |

|

| Secretariat | Risk Management Department |

| Frequency of committee meetings | In principle, at least 3 times/year Meets on an ad hoc basis during emergencies |

*The Risk Management Committee consists of members selected from both domestic and international members.

Material Risks

Under its Enterprise Risk Management (ERM) system, Ushio Group recognizes that events that may impede the implementation of our Management Philosophy and the enhancement of corporate value are "risks," which we manage appropriately covering the entire Group. In fiscal 2023, we reviewed our existing risk management processes, developed risk assessment tools, restructured our risk assessment processes, and started assessment-based risk reduction activities.

Ushio Group assesses the 66 identified risks annually from both qualitative and quantitative perspectives, e.g., impact and frequency, based on specific scenarios, following the Risk Management Regulations. Assessments are conducted by each business division, headquarters, and Group companies in Japan and overseas. The results are collected and tabulated by the Risk Management Committee Secretariat, and interviews are conducted with the managers of the responding departments. Candidates for material risks are selected from the obtained data and information, and results of interviews, proposed to the Risk Management Committee, and the approved material risks are reported to the Board of Directors.

After that, the risk owner drafts a countermeasure plan and takes appropriate actions. The Risk Management Committee Secretariat monitors the status of risk responses, regularly deliberates at meetings, and reports to the Board of Directors in an effort to strengthen the governance of the entire Group.

Furthermore, risks related to management strategies not included here are not managed by the Risk Management Committee due to the nature of the risks, but rather are managed based on decisions made by meetings attended by executive management and by each business division. For business risks, please see our Annual Securities Report.

For details, please see of our Annual Securities Report from the link below.

Overview of Material Risks and Countermeasures

| Material Risks | Risk scenarios | Responses to risk | E | S | G |

|---|---|---|---|---|---|

| Supply chain |

|

|

|||

| Business continuity |

|

|

|||

| Overseas crisis management |

|

|

|||

| Global personnel strategy |

|

|

● | ||

| Information security management |

|

|

● | ||

| Climate change measures |

|

|

● |